“My salary hasn’t changed much, my lifestyle hasn’t exploded… yet my savings feel tighter.”

Rita felt this discomfort many investors experience but can’t clearly explain.

No big shopping sprees. No luxury upgrades. Still, money felt like it was quietly slipping away.

Think of it like this

You haven’t bought a new car, but somehow your fuel bill keeps rising.

That’s when Ravi pointed out something most investors ignore.

We Chase Returns, But Ignore Leaks

Ravi told Rita something uncomfortable but true:

“Most investors spend hours chasing 1% extra return in mutual funds, but ignore the 2% silently leaking from their bank accounts.”

How?

Auto-payments. Subscriptions. Free trials that weren’t really free.

- OTT platforms you barely watch

- Research tools you tried once

- Apps you forgot you even installed

Each one feels “small”. ₹199 here. ₹299 there.

Just like daily snacks—tea, samosa, coffee—none feel expensive… until month-end

The “Invisible SIP” Problem

Ravi calls this the Invisible SIP.

Just like you run a SIP into mutual funds every month, you’re unknowingly running a reverse SIP—money going out every month.

Example:

- ₹99 app subscription

- ₹199 OTT platform

- ₹299 AI tool

- ₹149 cloud storage

That’s ₹700+ every month.

Not painful.

Not noticeable.

But very real.

“But How Do I Find These?” – Rita’s Question

Rita asked the right question:

“Do I really need to check months of SMS alerts and bank statements?”

Thankfully, no.

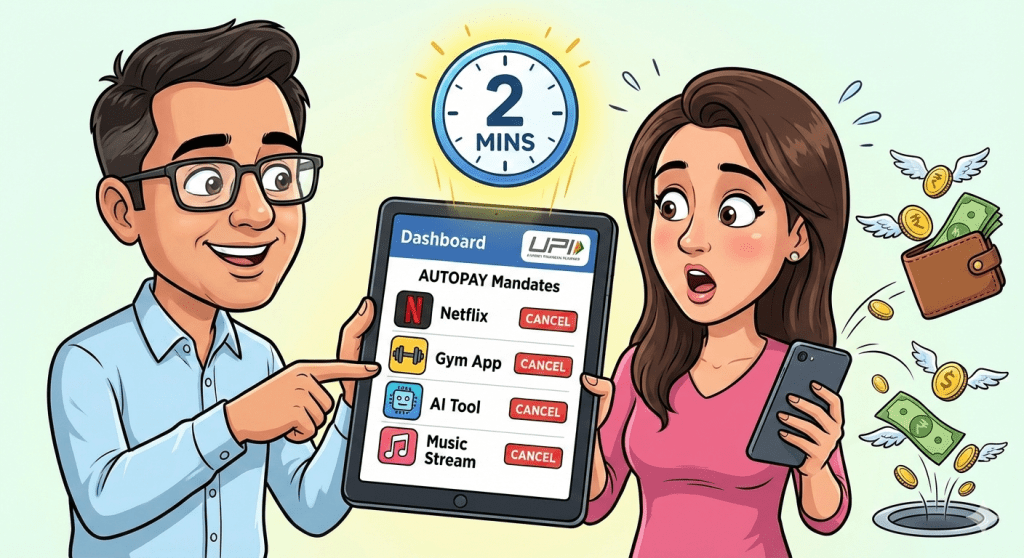

The NPCI Autopay Dashboard (Your Subscription Mirror)

Think of NPCI’s portal like a credit report, but for your auto-payments.

It shows:

- Every UPI Autopay mandate

- Every active subscription

- Every app quietly charging you

All in one place.

The 2-Minute Audit (Anyone Can Do This)

Here’s exactly what Rita did:

- Go to upihelp.npci.org.in

- Enter your UPI-linked mobile number

- Verify with OTP

- Click “Show my AUTOPAY mandates”

- Review Active mandates

- Cancel what you don’t clearly use or value

That’s it.

No app hopping.

No digging through statements.

The “Aha” Moment

Within seconds, Rita spotted:

- A financial news subscription she stopped reading last year

- An AI design tool charging ~$6 (₹500+) every month

(She hadn’t logged in for months)

Total damage?

₹500 per month

“₹500 Isn’t a Big Deal… Right?”

This is where investors underestimate compounding.

Ravi asked Rita to think differently:

“What if this ₹500 wasn’t wasted—but invested?”

Small Leak vs Smart Investment

Let’s compare

Scenario 1: Do Nothing

- ₹500 wasted every month

- ₹6,000 gone every year

- ₹1.2 lakh lost over 20 years

Scenario 2: Redirect ₹500 into an Index Fund (12% CAGR)

- Same ₹500 every month

- Over 20 years → ~₹5 lakh

Same money. Different direction.

That’s the real cost of “small amounts”.

The Bigger Lesson for Investors

Wealth creation isn’t only about:

- Finding the best fund

- Timing the market

- Chasing returns

It’s also about plugging leaks.

Just like:

- A bucket with a hole won’t fill

- A salary with silent drains won’t compound

Convenience is useful. But unchecked convenience is expensive.

Make This a Habit

Rita decided to:

- Audit autopay mandates once every quarter

- Treat unwanted subscriptions like bad investments

- Redirect “found money” into SIPs

A simple habit.

A powerful outcome.

Final Thought

Before asking: “Which mutual fund will give me higher returns?”

Ask: “Where is my money quietly escaping?”

Because stopping a leak often creates more wealth than chasing the next multi-bagger.