Raj, a 38-year-old private sector employee, had a simple ritual.

Once a year, usually around tax-saving season, he would log in to his NPS account, download his statement, glance at the numbers, feel reassured—and log out.

But this year was different.

An email from NPS caught his eye: “Scheme A will be merged with Schemes C and E…”

Raj frowned.

“Merge? Scheme A? Did I invest in something risky without knowing?”

“Will my retirement money be affected?”

“And is this change only for private sector employees like me?”

By evening, Raj did what most sensible investors do when confused.

He called Sunil, his long-time financial planner.

“Sunil, my NPS statement is changing. Should I be worried?”

Sunil smiled.

“Relax, Raj. Nothing has gone wrong. In fact, this is a clean-up exercise, not a problem.”

Seeing Raj still anxious, Sunil pulled out a notebook.

“Let me explain this the easy way.”

What exactly was Scheme A?

“Raj,” Sunil began,

“Scheme A was an optional asset class under NPS Active Choice. It invested in things like infrastructure funds, REITs, and InvITs—what we call alternative investments.”

Raj nodded slowly.

“But,” Sunil continued, “very few people chose it.

The corpus stayed small, liquidity was limited, and some investments had long lock-ins. Not ideal for a pension product.”

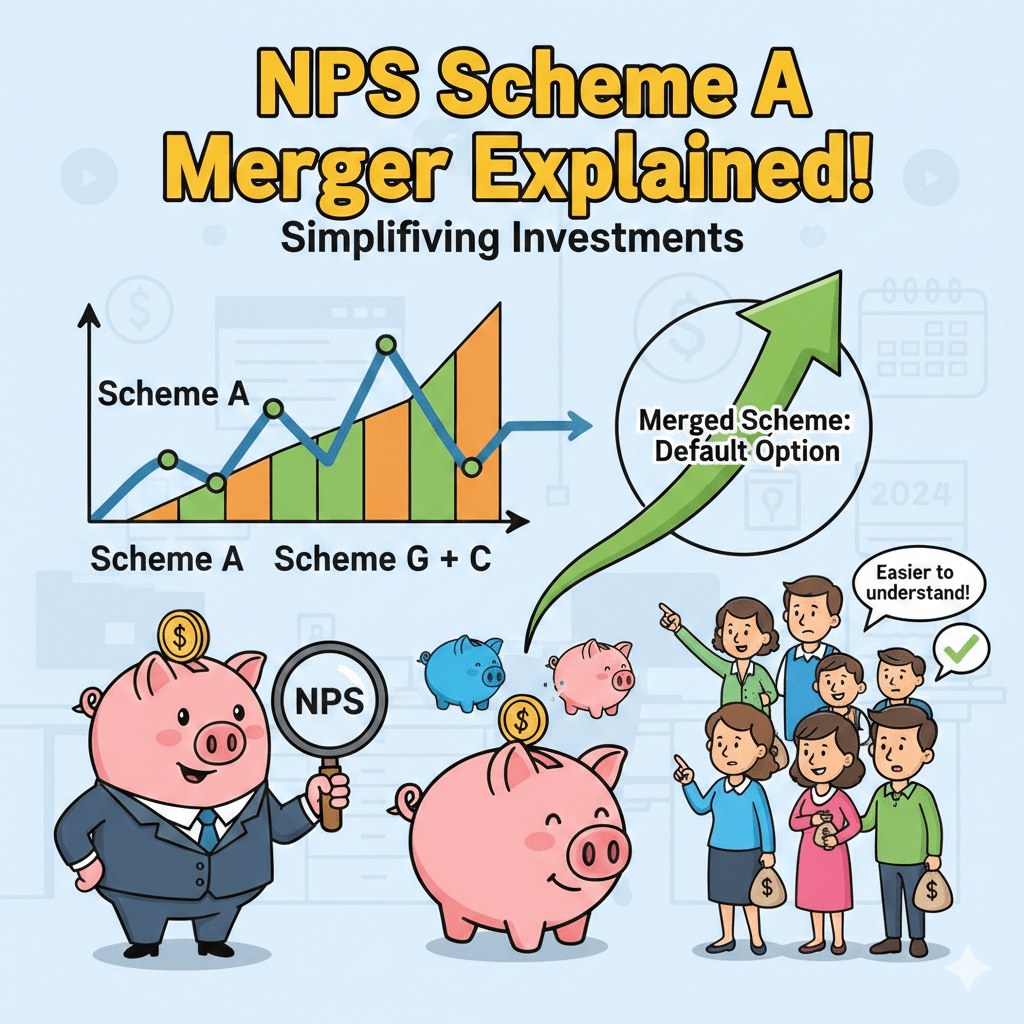

So why is Scheme A being merged now?

Sunil explained:

“PFRDA looked at three things:

1. Scheme A was too small to manage efficiently

2. It had liquidity constraints

3. Regulators want simpler, cleaner investment structures

So they decided: Let’s merge Scheme A into Scheme C (Corporate Bonds) and Scheme E (Equities)—larger, well-diversified, liquid schemes.”

Raj leaned back.

“So this isn’t because markets crashed or returns were bad?”

“Exactly,” Sunil said.

“This is preventive maintenance, not damage control.”

“But is this only for private sector employees like me?”

Raj’s next question came quickly.

Sunil shook his head.

“No. This applies to everyone who had opted for Scheme A:

- Private sector employees

- Government employees

- Corporate NPS subscribers

- All Citizens NPS

You’re hearing about it because Active Choice subscribers were the ones using Scheme A.”

Do I need to do anything now?

Sunil laid out the options clearly.

“You have two choices, Raj:

Option 1: Do nothing

- Scheme A money will be automatically merged

- No tax impact

- No charges

- No paperwork

Option 2: Use the free switch window

- Till 25 December 2025, you can reallocate that money

- You can choose how much goes into:

- Scheme E (Equity)

- Scheme C (Corporate Bonds)

- Scheme G (Government Securities)

- No switching cost for this move”

Raj smiled.

“At least they’re giving time.

“Now the important part—how should I invest post merger?”

Sunil leaned forward.

“Raj, you’re 38. Private sector. Long runway till retirement.

This change is actually a good opportunity to reset your NPS correctly.”

He wrote three letters on paper: E – C – G

Sunil’s suggested post-merger allocation for Raj

For someone below 40:

| Scheme | Allocation |

|---|---|

| Scheme E (Equity) | 70–75% |

| Scheme C (Corporate Bonds) | 20–25% |

| Scheme G (G-Secs) | 5–10% |

“This,” Sunil said, “does three things:

- Equity captures India’s long-term growth

- Bonds reduce volatility

- G-Secs provide stability without dragging returns too much”

Then he added:

“If you want something simple and low-maintenance, just remember this.”

E 60% – C 30% – G 10%

“It works beautifully for most people between 35 and 45.”

Raj’s final takeaway

Raj closed his notebook, visibly relaxed.

“So my retirement is safe.

The scheme is simpler.

And I actually get a chance to improve my allocation.”

Sunil nodded.

“That’s the right way to see it.

NPS is a long-distance train, Raj. Track maintenance doesn’t stop the journey—it makes it smoother.”

Raj smiled.

For the first time, that NPS email didn’t feel like bad news.

It felt like a course correction done in time.

✍️ Note

If you’ve received a similar NPS message and are unsure what to do, remember:

- This change applies to all Scheme A investors

- You have time till Dec 2025 to act

- A simple, age-appropriate E–C–G allocation is all you need